Table of Contents

Introduction

Unicorn is the term used in the venture capital industry to describe a startup company valued at over $1 billion. The value of unicorns is generally based on how investors and venture capitalists anticipate their growth and development.

As we enter 2024, the global economic landscape is being reshaped by a group of high-growth industries. These companies, valued at over $1 billion, are no longer confined to Silicon Valley but are emerging from all parts of the world.

In this guide, we delve into the most influential unicorns of 2024 and how their disruptive power is shaping the global economy, creating new opportunities, and redefining the future of global business.

Top 10 Unicorns by Valuation

As the global economy continues to evolve, several unicorn companies have emerged as dominant players, leading in innovation, technology, and disruption across multiple industries. Below are some of the top unicorns by valuation in 2024:

Bytedance (Valuation:$225B)

- Industry: Social Media, AI, Technology

- Headquarters: Beijing, China

- Key Innovations: As the parent company of TikTok and Douyin, ByteDance is in charge of social media and content algorithms, leveraging artificial intelligence to shape the future of entertainment and e-commerce.

SpaceX (Valuation:$200B)

- Industry: Aerospace, Space Exploration

- Headquarters: Hawthorne, California, USA

- Key Innovations: SpaceX continues to push the boundaries of space exploration with its reusable rockets and the Starship program, aimed at Mars colonization. Starlink’s satellite-based internet service is also expanding rapidly, making global internet access a reality in remote areas.

OpenAI (Valuation:$157B)

- Industry: Artificial Intelligence, Research

- Headquarters: San Francisco, California, USA

- Key Innovations: OpenAI is revolutionizing the AI space with advancements in natural language processing, generative AI, and deep learning, reshaping automation and creativity across multiple industries.

Stripe (Valuation:$70B)

- Industry: Fintech, Payments

- Headquarters: San Francisco, California, USA

- Key Innovations: Stripe’s cutting-edge payment processing solutions are central to the global digital economy. They facilitate seamless online transactions for businesses worldwide and provide crucial infrastructure for e-commerce and fintech companies.

Shein (Valuation:$66B)

- Industry: E-commerce, Fashion

- Headquarters: Nanjing, China

- Key Innovations: Shein has become a global fast-fashion juggernaut by using big data to forecast trends and adjust its supply chain in real-time. Its hyper-efficient model allows it to churn out affordable, on-trend clothing at an unprecedented pace, which has resulted in a massive global footprint and loyal customer base.

Revolut (Valuation:$45B)

- Industry: Fintech, Neobanking

- Headquarters: London, UK

- Key Innovations: Revolut provides various digital financial services such as banking, stock trading, crypto, and insurance through its user-friendly app. It aims to expand its user base by adding new features and entering new markets.

Databricks (Valuation:$43B)

- Industry: Data, AI, Software

- Headquarters: San Francisco, California, USA

- Key Innovations: Databricks is transforming data analytics by offering a unified platform for data engineering, machine learning, and AI applications. Its lakehouse architecture is gaining widespread adoption, enabling companies to make data-driven decisions at scale and integrate AI into their workflows more effectively.

Fanatics (Valuation:$31B)

- Industry: E-commerce, Sports Merchandising

- Headquarters: Jacksonville, Florida, USA

- Key Innovations: Fanatics dominates the sports merchandise industry, focusing on producing and selling officially licensed sports apparel and collectibles. It has expanded into the digital realm, offering personalized fan experiences and leveraging technology to drive e-commerce growth in the sports world.

Canva (Valuation: $25B)

- Industry: Design Software, SaaS

- Headquarters: Sydney, Australia

- Key Innovations: Canva has democratized design by offering a user-friendly, web-based platform that allows anyone to create professional-quality graphics. From small businesses to large enterprises, Canva’s intuitive tools have made it a go-to for marketing, branding, and content creation across industries.

Chime (Valuation:$25B)

- Industry: Fintech, Neobanking

- Headquarters: San Francisco, California, USA

- Key Innovations: Chime is reshaping the banking landscape by offering a fee-free mobile banking experience. With features like early paycheck access, automatic savings, and no overdraft fees, it’s gaining popularity among young and underserved consumers, accelerating the shift towards digital-first banking.

These unicorns are not only leaders in valuation but are at the forefront of driving technological innovation, financial inclusivity, and consumer-centric solutions across the globe.

Emerging Trends Among Unicorns

Dominance of Tech and AI Startups

- Tech and AI Leading the Way: Startups focused on artificial intelligence and technology are outpacing others in innovation and value creation. Unicorns like OpenAI and Databricks are capitalizing on the increasing demand for AI-driven automation, analytics, and efficiency solutions across sectors.

- Global Expansion of AI Capabilities: AI unicorns are not only enhancing productivity but also transforming industries such as healthcare, finance, and e-commerce by integrating deep learning and advanced algorithms into their core operations.

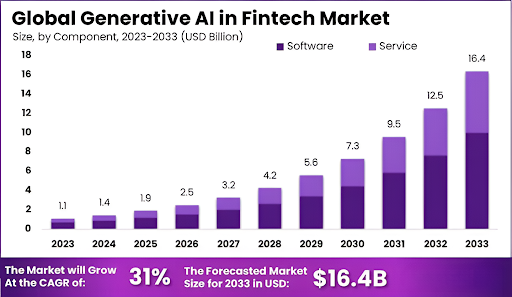

Rise of Fintech, Fashion, and Space Exploration

- Fintech Boom: Companies like Stripe, Revolut, and Chime are transforming the financial landscape by offering seamless digital payment solutions, mobile banking, and innovative fintech services.

- Fast Fashion Disruption: Shein has taken the fast-fashion world by storm, leveraging data and technology to predict trends and optimize supply chains in real time.

- Commercial Space Exploration: SpaceX continues to push the envelope with its focus on reusable rockets and space missions, positioning space exploration and satellite internet services as profitable industries with long-term global implications.

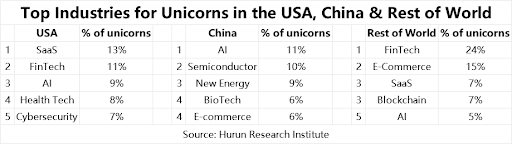

Global Unicorn Distribution

U.S. vs. China Dominance

- United States: The U.S. remains the leader in unicorn creation, with companies like SpaceX, OpenAI, and Stripe representing the country’s dominance in technology, AI, and fintech. Silicon Valley remains a hub for innovation, fueled by extensive venture capital investment and a strong entrepreneurial ecosystem.

- China: With unicorns like ByteDance and Shein, China is rapidly closing the gap with the U.S., excelling in AI, e-commerce, and fintech. The sheer size of its domestic market, coupled with supportive government policies, makes China a formidable player in the unicorn ecosystem.

New Players: Singapore, UK, and Others

- Singapore: The city-state is becoming a key player in the global unicorn landscape, especially in fintech and mobility. Unicorns like Grab demonstrate Singapore’s capacity to produce billion-dollar companies that serve Southeast Asia’s growing market.

- United Kingdom: London is emerging as a top hub for fintech innovation, with unicorns like Revolut leading the charge. The UK’s strong financial regulatory environment and access to European markets make it a hotspot for fintech unicorns.

- Other Emerging Markets: Countries like India, Israel, and Germany are increasingly contributing to the unicorn landscape, with startups in AI, healthcare, cybersecurity, and enterprise technology gaining traction and attracting significant investment.

While the U.S. and China maintain dominance, new players like Singapore and the UK are increasingly contributing to this vibrant and competitive landscape.

The AI Revolution

OpenAI and the Surge in AI-Driven Companies

- OpenAI’s Leadership in AI: OpenAI is not just a unicorn but a catalyst for a new wave of AI-driven startups, as companies leverage its technology to build AI-powered products across various sectors—healthcare, education, customer service, and more.

- AI Startups on the Rise: Beyond OpenAI, there’s been a surge of startups focused on artificial intelligence. Companies like Databricks are building AI tools for big data analytics, while others are innovating in fields like AI-powered automation, robotics, and natural language processing.

Impact of ChatGPT and Related Technologies

- Transforming Industries: ChatGPT has transformed how companies handle customer service, content creation, and communication. Businesses can now automate routine tasks, improve productivity, and personalize customer interactions at scale.

- AI’s Influence on Innovation: The launch of ChatGPT and similar technologies has sparked an entire ecosystem of AI innovation. AI is permeating every industry, accelerating digital transformation and sparking new business models focused on automation, efficiency, and data-driven insights.

Fintech Powerhouses

Stripe, Revolut, and the Transformation of Financial Services

- Stripe: Stripe leads the fintech space with seamless payment processing solutions for businesses of all sizes. It revolutionizes online payments, making global scaling easier.

- Revolut: Revolut is revolutionizing banking with its mobile-first platform, offering currency exchange, cryptocurrency trading, and personal loans. Its borderless financial services are expanding globally.

- Fintech’s Broader Impact: Fintech unicorns like Stripe and Revolut are at the heart of a larger transformation within the financial services industry. They are promoting financial inclusivity, simplifying payments, and enabling instant global transactions.

Unicorn Impact on the Global Economy

Combined Valuation Surpassing Nations

- Economic Powerhouses: The combined valuation of unicorns now surpasses the GDP of many nations, highlighting the disruptive power of high-growth startups and their ability to influence global markets.

- Driving Innovation and Jobs: Unicorns contribute through valuations, drive innovation, create jobs, and fuel entrepreneurship. Their success sets new industry standards and technological advancements benefit economies on a macro level.

Potential for Future Growth

- Exponential Scaling: Unicorns are expanding globally, tapping into emerging markets, and pioneering new technologies. The rapid adoption of digital services and automation suggests continued growth and industry-shaping.

- Expanding into Untapped Markets: Unicorns are increasingly focusing on developing regions like Southeast Asia, Africa, and Latin America for global expansion.

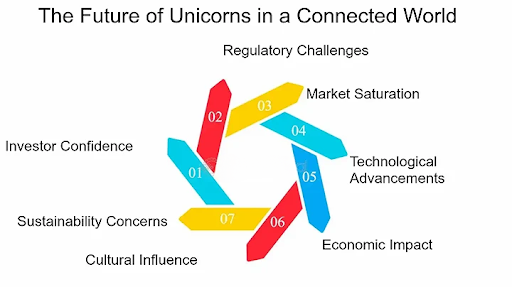

What’s Next for Unicorns?

- AI and Automation Will Dominate: The future of unicorns will likely see continued dominance in artificial intelligence and automation. AI-driven startups will revolutionize industries like healthcare, manufacturing, logistics, and education, providing smarter solutions that scale globally.

- Fintech and DeFi Growth: The fintech space, including decentralized finance (DeFi), will see continued expansion as more consumers and businesses adopt digital wallets, cryptocurrencies, and borderless banking solutions.

- Space and Clean Tech Startups: As space exploration becomes more commercially viable, unicorns like SpaceX will pave the way for private space travel, satellite communication, and even asteroid mining.

As these startups continue to grow, they will set the stage for future innovation, with sustainability and ethical technology becoming crucial components of long-term success.

Conclusion

The rise of unicorns in 2024 marks a pivotal moment in the global economy. Companies like ByteDance, SpaceX, and OpenAI are reshaping industries with their transformative innovation in AI, fintech, and space exploration. Looking ahead, the next wave of unicorns will likely be fueled by advancements in AI, automation, decentralized finance, and sustainability.

The global unicorn ecosystem is becoming increasingly diverse, with new players emerging from regions like Singapore and the UK. Unicorns will continue to be the trailblazers of innovation, leading the charge in shaping a more technologically advanced, financially inclusive, and sustainable global economy.

Deepak Wadhwani has over 20 years experience in software/wireless technologies. He has worked with Fortune 500 companies including Intuit, ESRI, Qualcomm, Sprint, Verizon, Vodafone, Nortel, Microsoft and Oracle in over 60 countries. Deepak has worked on Internet marketing projects in San Diego, Los Angeles, Orange Country, Denver, Nashville, Kansas City, New York, San Francisco and Huntsville. Deepak has been a founder of technology Startups for one of the first Cityguides, yellow pages online and web based enterprise solutions. He is an internet marketing and technology expert & co-founder for a San Diego Internet marketing company.