Table of Contents

Introduction

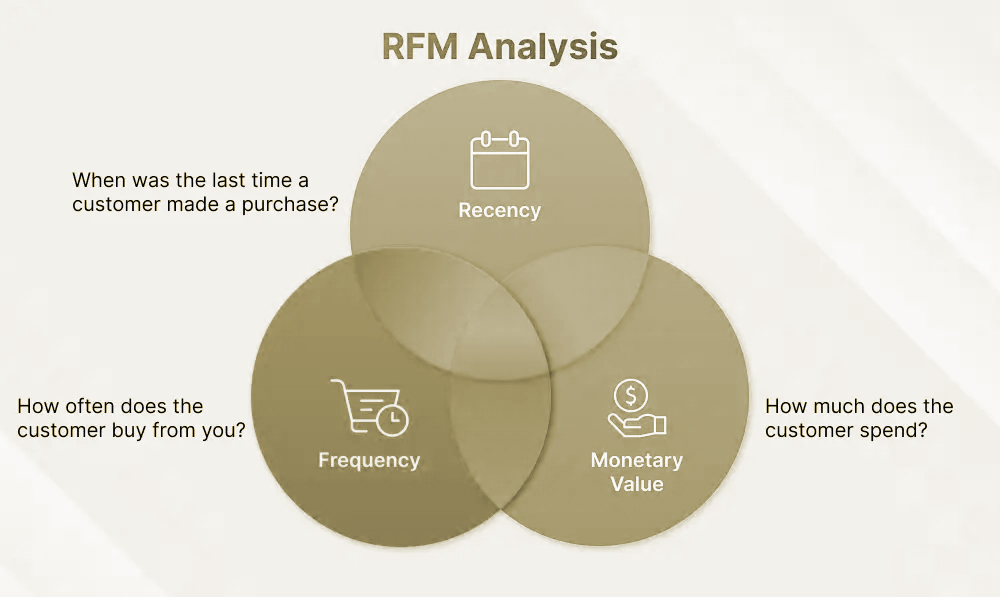

In today’s competitive market, understanding your customers is essential—not optional. RFM segmentation (Recency, Frequency, Monetary) helps you group customers based on how recently they purchased, how often they buy, and how much they spend.

By analyzing these three data points, you can deliver the right message to the right customer at the right time, leading to more relevant campaigns and stronger relationships. RFM works for e-commerce, SaaS, boutiques, and subscription businesses, making personalization scalable and effective.

As customer expectations rise, brands must deliver timely, personalized offers—or risk losing business to competitors. RFM removes guesswork so you know who to target, what to offer, and when to act.

Here’s how it works:

- Recency: How recently a customer made a purchase

- Frequency: How often they buy from you

- Monetary: How much they spend

In a world where attention is the new currency, RFM is your smart strategy for loyalty and revenue growth.

Understanding RFM Segmentation

Recency: Why Timing is Critical

Recency measures how long it’s been since a customer last made a purchase. This is one of the most predictive metrics in marketing. Customers who recently purchased are far more likely to respond to future promotions compared to those who haven’t interacted with your brand in months.

Offering loyalty points, upsell opportunities, or referral incentives right after a purchase can dramatically increase engagement. Timing is everything, and recency ensures your marketing messages hit when they’re most likely to be effective.

Using this metric, you can:

- Send timely follow-ups after purchases

- Re-engage lapsed customers with win-back campaigns

- Prioritize hot leads in your sales pipeline

Frequency: The Power of Repeat Purchases

Frequency tracks how often a customer makes purchases within a specific period. High-frequency customers are your brand advocates—they’re engaged, loyal, and far more profitable than one-time buyers.

In fact, studies show that increasing customer retention by just 5% can increase profits by 25% to 95%. That’s the kind of power frequent buyers hold.

With frequency data, you can:

- Identify your most loyal customers

- Reward them with exclusive offers or early access

- Understand which products drive repeat business

Monetary: Measuring Customer Value

The monetary component of RFM measures how much money a customer spends over time. It helps you differentiate between bargain hunters and big spenders. While both are important, your high-spenders are where your biggest opportunities lie.

Customers who spend more often have higher expectations—but they’re also more receptive to high-value offers, premium services, and VIP programs.

Monetary data lets you:

- Design tiered loyalty programs based on spend

- Offer exclusive bundles or discounts to top spenders

- Allocate more budget to retain high-value clients

Knowing who your big spenders are helps you prioritize resources wisely. Why spend equally on someone who bought once for $10 and someone who spends $500 monthly? RFM helps you focus where it counts.

Why RFM Improves Customer Insight

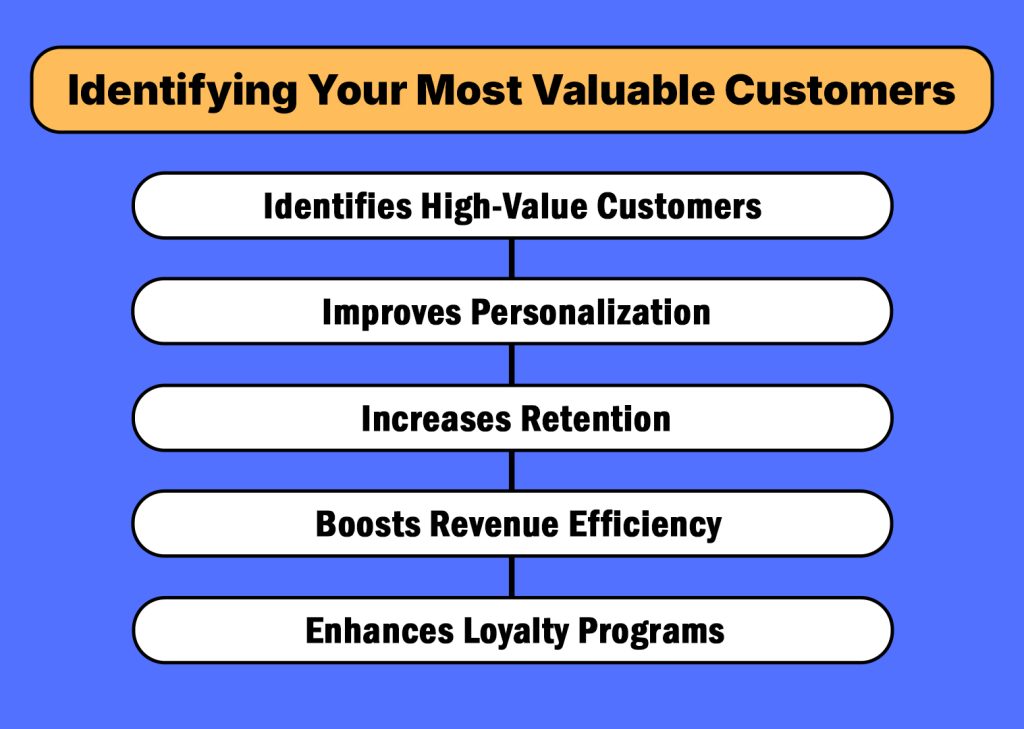

Identifying Your Most Valuable Customers

- Identifies high-value customers: RFM pinpoints the top 20% of customers who generate the majority of revenue, helping you focus on the most profitable segments.

- Improves personalization: By grouping customers based on behavior, RFM enables tailored messaging that resonates with each segment.

- Increases retention: Targeted win-back campaigns for “At-Risk” customers help prevent churn and extend customer lifetime value.

- Boosts revenue efficiency: Instead of spending evenly on all customers, RFM directs resources toward those most likely to buy again or spend more.

- Enhances loyalty programs: Businesses can reward Champions and Loyal Customers with exclusive offers, early access, or VIP perks to strengthen relationships.

Detecting At-Risk Customers

- Identifies slipping customers: RFM reveals customers who once purchased often but haven’t returned recently, placing them in the “at-risk” segment.

- Prevents silent churn: These customers are slowly disengaging, and without intervention, they are likely to churn—costing you future revenue.

- Creates win-back opportunities: At-risk customers are still familiar with your brand, making them more likely to respond to re-engagement efforts.

- Enables targeted recovery campaigns: You can reach out with limited-time discounts, personalized “We miss you” messages, or reminders of unused loyalty points to reignite interest.

- Reduces churn costs: Since acquiring new customers is far more expensive than retaining existing ones, RFM gives you a proactive way to win back value before it’s lost.

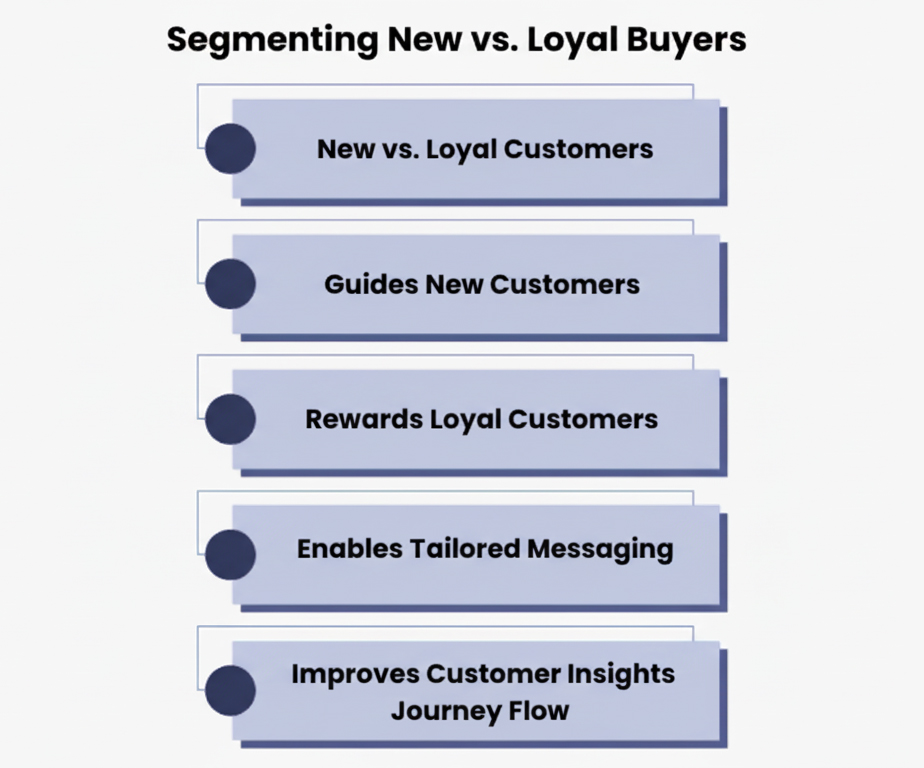

Segmenting New vs. Loyal Buyers

New vs. loyal customers: RFM makes it easy to see who is just starting their journey and who has already proven long-term loyalty, allowing for smarter engagement.

Guides new customers: New buyers benefit from onboarding emails, first-purchase coupons, and product education to build trust and encourage repeat purchases.

Rewards loyal customers strategically: Long-term customers respond better to referral incentives, loyalty rewards, and VIP-only access that make them feel valued.

Enables tailored messaging: Instead of using one-size-fits-all campaigns, RFM ensures each customer receives communication that aligns with their stage in the relationship.

Improves customer journey flow: By sending the right offers at the right time, you naturally guide each customer deeper into the funnel—boosting retention, loyalty, and lifetime value.

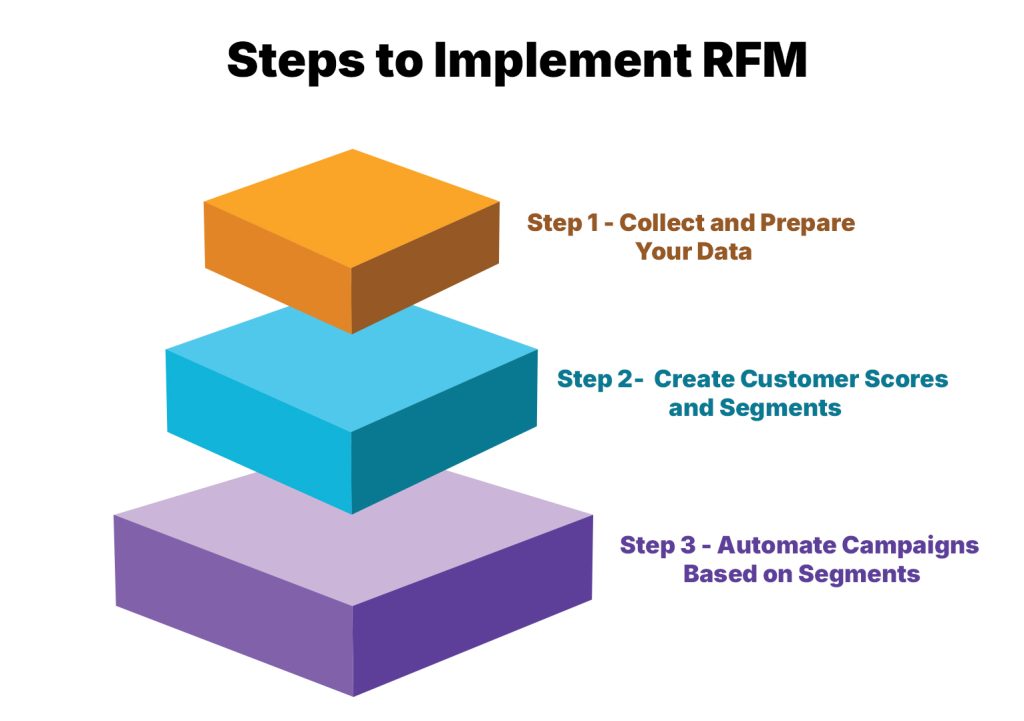

Steps to Implement RFM

Collect and Prepare Your Data

- Gather key data points: customer ID/email, purchase dates, and transaction amounts.

- Pull data from platforms like Shopify, WooCommerce, CRM tools (HubSpot, Salesforce), or email platforms (Klaviyo, Mailchimp).

- Clean the data by removing duplicates, standardizing date formats, and verifying transaction accuracy.

Create Customer Scores and Segments

- Assign scores (e.g., 1–5) for Recency, Frequency, and Monetary using quartiles or percentiles.

- Example: Top 25% in recency = score 5, bottom 25% in frequency = score 1.

- Combine scores to form powerful segments like:

- 555 = Champions

- 155 = New high-potential customers

- 511 = At-risk big spenders

- 111 = Dormant customers

- Label, track, and monitor these segments over time.

Automate Campaigns Based on Segments

- Trigger onboarding flows for new customers automatically.

- Send loyalty rewards or surprise perks to frequent buyers.

- Re-engage “At-Risk” customers with “We miss you” emails or special offers.

- Sync RFM segments with email, CRM, and ad platforms to launch dynamic campaigns.

Top Platforms Offering RFM Analysis

Thankfully, you don’t need to crunch numbers in Excel forever. There are several powerful tools that offer built-in RFM segmentation, making the process seamless, automated, and highly effective.

Here are some of the most popular platforms:

- Klaviyo: Offers advanced RFM segmentation for email marketing, perfect for e-commerce businesses.

- Shopify: Integrates customer behavior tracking and RFM directly into your store dashboard.

- Salesforce Marketing Cloud: Offers detailed behavioral segmentation with automated workflows for enterprise users.

- HubSpot: While not RFM-focused by default, its custom property capabilities allow for detailed segmentation when configured.

- Optimove: Uses RFM and predictive analytics to drive personalized customer marketing campaigns.

These tools not only segment customers but also help visualize behavior, automate campaigns, and analyze performance. When you choose the right tool, RFM becomes less of a data science project and more of a marketing superpower.

Case Studies

Land’s End

- Land’s End and JCPenney were among the earliest companies to adopt RFM analysis to optimize their mail-order catalog campaigns.

- By analyzing Recency, Frequency, and Monetary value, they identified which customers were most likely to buy again.

- Instead of mailing catalogs to everyone, they focused only on high-potential segments.

- This helped them reduce mailing costs significantly while improving response rates and ROI—a major innovation in direct marketing at the time.

Eastwood

- Eastwood, an automotive tools and supplies retailer, integrated RFM segmentation into its email marketing strategy.

- By grouping customers based on purchase behavior, the brand delivered more relevant product recommendations and offers.

- The result was a 21% increase in email marketing profits, proving that even small improvements in personalization can lead to substantial revenue growth.

L’Occitane

- L’Occitane, a global cosmetics and skincare brand, implemented RFM to better understand customer value and tailor communication.

- With precise segmentation, they created highly targeted and personalized email campaigns.

- This transformation led to 25 times more revenue from email marketing—a dramatic example of how RFM can elevate customer engagement and maximize lifetime value at scale.

Frederick’s of Hollywood

- Frederick’s of Hollywood used RFM analysis to refine their customer segments and tailor promotional campaigns.

- Instead of sending generic offers, they customized messaging based on recency of purchase and spending patterns.

- This smarter targeting strategy resulted in a 6–9% increase in conversions, demonstrating that even modest segmentation can produce measurable performance gains.

Moosejaw

- Moosejaw, a leading outdoor apparel and gear retailer, adopted RFM analysis to identify loyal customers and at-risk segments.

- They used these insights to send personalized emails, re-engagement offers, and targeted promotions.

- RFM helped Moosejaw boost customer engagement and drive consistent revenue growth, making it a key part of their retention and email marketing strategy.

Conclusion

RFM segmentation isn’t just a marketing buzzword—it’s a game-changer for businesses that want to understand their customers, personalize experiences, and drive revenue. By focusing on Recency, Frequency, and Monetary value, you gain a clear, actionable view of customer behavior.

Whether you’re trying to win back at-risk customers, reward loyal ones, or optimize your marketing spend, RFM segmentation equips you with the data and structure needed to make it happen. With the right tools and strategy, it can transform your customer relationships—and your bottom line.

It’s not just about selling more. It’s about creating an experience that makes customers want to stick around, again and again.

Deepak Wadhwani has over 20 years experience in software/wireless technologies. He has worked with Fortune 500 companies including Intuit, ESRI, Qualcomm, Sprint, Verizon, Vodafone, Nortel, Microsoft and Oracle in over 60 countries. Deepak has worked on Internet marketing projects in San Diego, Los Angeles, Orange Country, Denver, Nashville, Kansas City, New York, San Francisco and Huntsville. Deepak has been a founder of technology Startups for one of the first Cityguides, yellow pages online and web based enterprise solutions. He is an internet marketing and technology expert & co-founder for a San Diego Internet marketing company.